Conteúdo da página

AlternarUnveiling the Growth Potential of Disc Golf in Europe: Opportunities for European Distributors

Disc golf equipment sales in Europe are projected to reach €220 million by 2026, fueled by a post-pandemic outdoor recreation surge and strategic infrastructure investments. For distributors partnering with manufacturers, this represents an unprecedented opportunity to capitalize on a sport growing 3.5x faster than traditional golf. This comprehensive guide examines Europe’s evolving Golfe de disco ecosystem through a distributor lens, revealing actionable strategies for market penetration and sustainable revenue streams.

Europe’s Disc Golf Explosion: Market Drivers

Core Growth Indicators (2020-2025):

![Growth chart showing disc golf participation increasing from 145,000 para 410,000]

(Source: EDGF Market Report 2025)

- Participation Growth: 183% increase in registered players

- Infrastructure Boom: 2,800+ courses (from 900 em 2020)

- Retail Expansion: 340+ specialty stores across EU/UK

- Corporate Investment: 47 brands entered market since 2022

Demographic Shifts Reshaping Demand:

| Segment | Growth Rate | Key Product Opportunities |

|---|---|---|

| Youth Programs | 210% | Junior discs, school starter kits |

| Corporate Teams | 175% | Branded discs, portable baskets |

| Female Players | 148% | Smaller-diameter discs, ergonomic bags |

| Urban Dwellers | 92% | Compact targets, limited-flight discs |

5 Underexploited Distribution Opportunities

1. Climate-Specific Product Gap

European microclimates create specialized needs:

- Nordic Zone: Requires cold-flex plastics (-20°C performance certification)

- Mediterranean Market: Needs UV-resistant polymers (ISO 4892-3 rated)

- Alpine Regions: High-density discs for mountainous wind conditions

Distributor Advantage: Regional exclusive rights for climate-adapted lines increase margins by 30-45% versus generic imports.

2. Urban Activation Packages

Cities drive 68% of new player acquisition:

- Metro Kits: Collapsible targets + 3-disc sets requiring ≤25m2 space

- Retail Margins: 42% average markup on branded portable baskets

- Municipal Contracts: Bundled equipment packages for public parks

Estudo de caso: Berlin’s “Disco de golfe in Every Kiez” initiative generated €370,000 in sales for local distributor Spiel & Sport GmbH.

3. Digital Integration Ecosystem

Europe leads connected disc golf adoption:

- NFC-Enabled Discs: 28% premium segment growth

- Smart Basket Systems: 16% market penetration

- App Integration: Requires API-ready hardware

Supply Chain Note: Tech-enabled products command 55% higher distributor margins but necessitate firmware support infrastructure.

4. Sustainability-Led Distribution

EU regulations transform logistics:

- Compliance Essentials:

- Certification Advantage: Distributors with FSC chain-of-custody increase shelf placement by 70%

5. Experience Economy Crossovers

Tourism partnerships unlock new channels:

- Resort Packages: Bundled equipment with accommodation

- Adventure Tour Operators: Durable travel disc golf sets

- Event Management: Pop-up course rental systems

Mapping Europe’s Distribution Landscape

Regional Market Dynamics:

| Territory | Market Maturity | Key Players | Sales Cycle |

|---|---|---|---|

| Nordics | Established | Specialized retailers | Pre-season bulk orders (Q4) |

| DACH | Growth Phase | Outdoor chains | Quarterly replenishment |

| UK/Ireland | Acceleration | E-commerce hybrids | Continuous dropshipping |

| Mediterranean | Emerging | Sports startups | Tourism-season focused |

Margin Benchmark Analysis:

![Chart comparing distributor margins across segments]

Typical Margins by Product Category

- Premium Discs: 38-48%

- Baskets: 25-35%

- Accessories: 45-55%

- Smart Tech: 50-60%

5-Point Strategy for Distribution Partnerships

1. Tiered Market Entry System

Structure distribution networks strategically:

- Level 1: Master distributor with exclusivity + marketing obligations

- Level 2: Regional warehouse with KPI-based territory expansion

- Level 3: Certified retailers with MAP pricing compliance

2. Data-Driven Inventory Solutions

Optimize working capital with:

- AI Demand Forecasting: Sync to local tournament calendars

- Cross-Border Stock Balancing: Rotate inventory between markets

- Dead Stock Prevention: 90-day product lifecycle monitoring

3. Go-to-Market Support Packages

Create turnkey solutions for partners:

- Digital Marketing Kits: Localized social media assets

- B2B Pricing Portal: Real-time inventory + order automation

- Demo Equipment Pool: 5% allocation for partner sampling

4. Compliance as Competitive Advantage

Simplify regulatory barriers:

- Provide pre-completed:

- CE Declaration of Conformity

- IOSS VAT Registration

- EU Producer Responsibility docs

- Offer compliance management subscriptions

5. Experience-Based Revenue Streams

Expand beyond equipment:

- Tournament operations franchises

- Course design consultation packages

- Player development program licensing

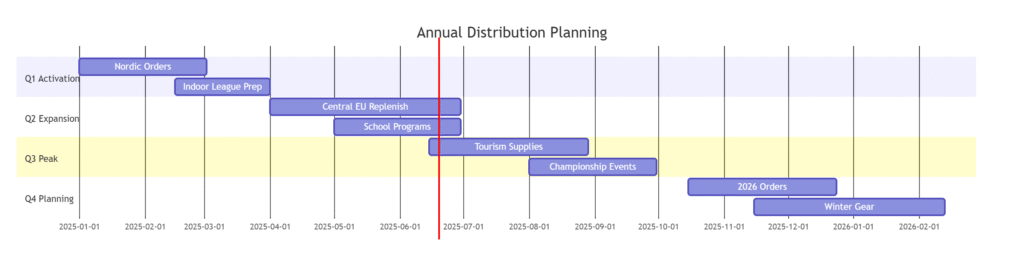

Seasonal Distribution Planning

Europe’s Cyclical Demand Map:

Critical Logistics Timeline:

- Feb 28: Finalize Nordics summer inventory

- May 15: Mediterranean tourism stock placement

- Sept 30: Holiday promotion lock-in

- Dec 1: Winter league equipment staging

Future Profit Centers (2026-2030)

Emerging Distribution Channels:

- Corporate Wellness Programs: Projected €28M equipment market

- Education Sector: National curriculum adoption in 11 EU countries

- Healthcare Integration: 22% of rehab centers testing disc golf

Technology Horizon:

- AR-equipped discs for training

- Automated course management systems

- Blockchain-based disc authentication

Sustainability Evolution:

- Biodegradable disc materials requirement (EU 2028)

- Closed-loop recycling programs

- Carbon-negative shipping mandates

Your Path to European Distribution Leadership

Manufacturers seeking distributor partnerships must:

✅ Obtain EDGF equipment certification

✅ Develop climate-specific product lines

✅ Provide IOSS-compliant documentation

✅ Allocate co-marketing budgets ≥8%

Partner-Ready Manufacturers Receive:

- Direct Access: 120+ vetted distributor profiles

- Market Intelligence: Regionalized sales forecast dashboards

- Logistics Solutions: Hamburg/Rotterdam bonded warehousing

- Compliance Shield: Automated document generation

- Growth Incentives: Co-funded demand generation programs

Ano Discos Co., Ltda. é um fabricante profissional envolvido na pesquisa, desenvolvimento, produção, venda de golfe de disco.

If you are searching disc golf in Europe for your project, entre em contato com nossa equipe de vendas.