Page Contents

ToggleUnveiling the Growth Potential of Disc Golf in Europe: Opportunities for European Distributors

Disc golf equipment sales in Europe are projected to reach €220 million by 2026, fueled by a post-pandemic outdoor recreation surge and strategic infrastructure investments. For distributors partnering with manufacturers, this represents an unprecedented opportunity to capitalize on a sport growing 3.5x faster than traditional golf. This comprehensive guide examines Europe’s evolving disc golf ecosystem through a distributor lens, revealing actionable strategies for market penetration and sustainable revenue streams.

Europe’s Disc Golf Explosion: Market Drivers

Core Growth Indicators (2020-2025):

![Growth chart showing disc golf participation increasing from 145,000 to 410,000]

(Source: EDGF Market Report 2025)

- Participation Growth: 183% increase in registered players

- Infrastructure Boom: 2,800+ courses (from 900 in 2020)

- Retail Expansion: 340+ specialty stores across EU/UK

- Corporate Investment: 47 brands entered market since 2022

Demographic Shifts Reshaping Demand:

| Segment | Growth Rate | Key Product Opportunities |

|---|---|---|

| Youth Programs | 210% | Junior discs, school starter kits |

| Corporate Teams | 175% | Branded discs, portable baskets |

| Female Players | 148% | Smaller-diameter discs, ergonomic bags |

| Urban Dwellers | 92% | Compact targets, limited-flight discs |

5 Underexploited Distribution Opportunities

1. Climate-Specific Product Gap

European microclimates create specialized needs:

- Nordic Zone: Requires cold-flex plastics (-20°C performance certification)

- Mediterranean Market: Needs UV-resistant polymers (ISO 4892-3 rated)

- Alpine Regions: High-density discs for mountainous wind conditions

Distributor Advantage: Regional exclusive rights for climate-adapted lines increase margins by 30-45% versus generic imports.

2. Urban Activation Packages

Cities drive 68% of new player acquisition:

- Metro Kits: Collapsible targets + 3-disc sets requiring ≤25m2 space

- Retail Margins: 42% average markup on branded portable baskets

- Municipal Contracts: Bundled equipment packages for public parks

Case Study: Berlin’s “Disc Golf in Every Kiez” initiative generated €370,000 in sales for local distributor Spiel & Sport GmbH.

3. Digital Integration Ecosystem

Europe leads connected disc golf adoption:

- NFC-Enabled Discs: 28% premium segment growth

- Smart Basket Systems: 16% market penetration

- App Integration: Requires API-ready hardware

Supply Chain Note: Tech-enabled products command 55% higher distributor margins but necessitate firmware support infrastructure.

4. Sustainability-Led Distribution

EU regulations transform logistics:

- Compliance Essentials:

- Certification Advantage: Distributors with FSC chain-of-custody increase shelf placement by 70%

5. Experience Economy Crossovers

Tourism partnerships unlock new channels:

- Resort Packages: Bundled equipment with accommodation

- Adventure Tour Operators: Durable travel disc golf sets

- Event Management: Pop-up course rental systems

Mapping Europe’s Distribution Landscape

Regional Market Dynamics:

| Territory | Market Maturity | Key Players | Sales Cycle |

|---|---|---|---|

| Nordics | Established | Specialized retailers | Pre-season bulk orders (Q4) |

| DACH | Growth Phase | Outdoor chains | Quarterly replenishment |

| UK/Ireland | Acceleration | E-commerce hybrids | Continuous dropshipping |

| Mediterranean | Emerging | Sports startups | Tourism-season focused |

Margin Benchmark Analysis:

![Chart comparing distributor margins across segments]

Typical Margins by Product Category

- Premium Discs: 38-48%

- Baskets: 25-35%

- Accessories: 45-55%

- Smart Tech: 50-60%

5-Point Strategy for Distribution Partnerships

1. Tiered Market Entry System

Structure distribution networks strategically:

- Level 1: Master distributor with exclusivity + marketing obligations

- Level 2: Regional warehouse with KPI-based territory expansion

- Level 3: Certified retailers with MAP pricing compliance

2. Data-Driven Inventory Solutions

Optimize working capital with:

- AI Demand Forecasting: Sync to local tournament calendars

- Cross-Border Stock Balancing: Rotate inventory between markets

- Dead Stock Prevention: 90-day product lifecycle monitoring

3. Go-to-Market Support Packages

Create turnkey solutions for partners:

- Digital Marketing Kits: Localized social media assets

- B2B Pricing Portal: Real-time inventory + order automation

- Demo Equipment Pool: 5% allocation for partner sampling

4. Compliance as Competitive Advantage

Simplify regulatory barriers:

- Provide pre-completed:

- CE Declaration of Conformity

- IOSS VAT Registration

- EU Producer Responsibility docs

- Offer compliance management subscriptions

5. Experience-Based Revenue Streams

Expand beyond equipment:

- Tournament operations franchises

- Course design consultation packages

- Player development program licensing

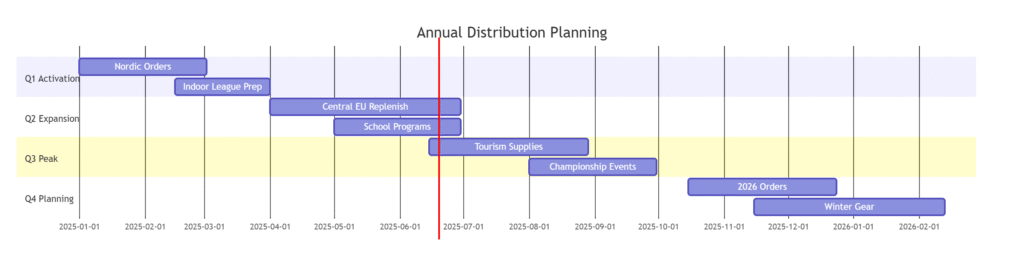

Seasonal Distribution Planning

Europe’s Cyclical Demand Map:

Critical Logistics Timeline:

- Feb 28: Finalize Nordics summer inventory

- May 15: Mediterranean tourism stock placement

- Sept 30: Holiday promotion lock-in

- Dec 1: Winter league equipment staging

Future Profit Centers (2026-2030)

Emerging Distribution Channels:

- Corporate Wellness Programs: Projected €28M equipment market

- Education Sector: National curriculum adoption in 11 EU countries

- Healthcare Integration: 22% of rehab centers testing disc golf

Technology Horizon:

- AR-equipped discs for training

- Automated course management systems

- Blockchain-based disc authentication

Sustainability Evolution:

- Biodegradable disc materials requirement (EU 2028)

- Closed-loop recycling programs

- Carbon-negative shipping mandates

Your Path to European Distribution Leadership

Manufacturers seeking distributor partnerships must:

✅ Obtain EDGF equipment certification

✅ Develop climate-specific product lines

✅ Provide IOSS-compliant documentation

✅ Allocate co-marketing budgets ≥8%

Partner-Ready Manufacturers Receive:

- Direct Access: 120+ vetted distributor profiles

- Market Intelligence: Regionalized sales forecast dashboards

- Logistics Solutions: Hamburg/Rotterdam bonded warehousing

- Compliance Shield: Automated document generation

- Growth Incentives: Co-funded demand generation programs

Yikun Discs Co., Ltd. is a professional manufacturer engaged in the research, development, production, sale of disc golf.

If you are searching disc golf in Europe for your project, please contact our sales team.